Consumer Duty Policy

About Consumer Duty

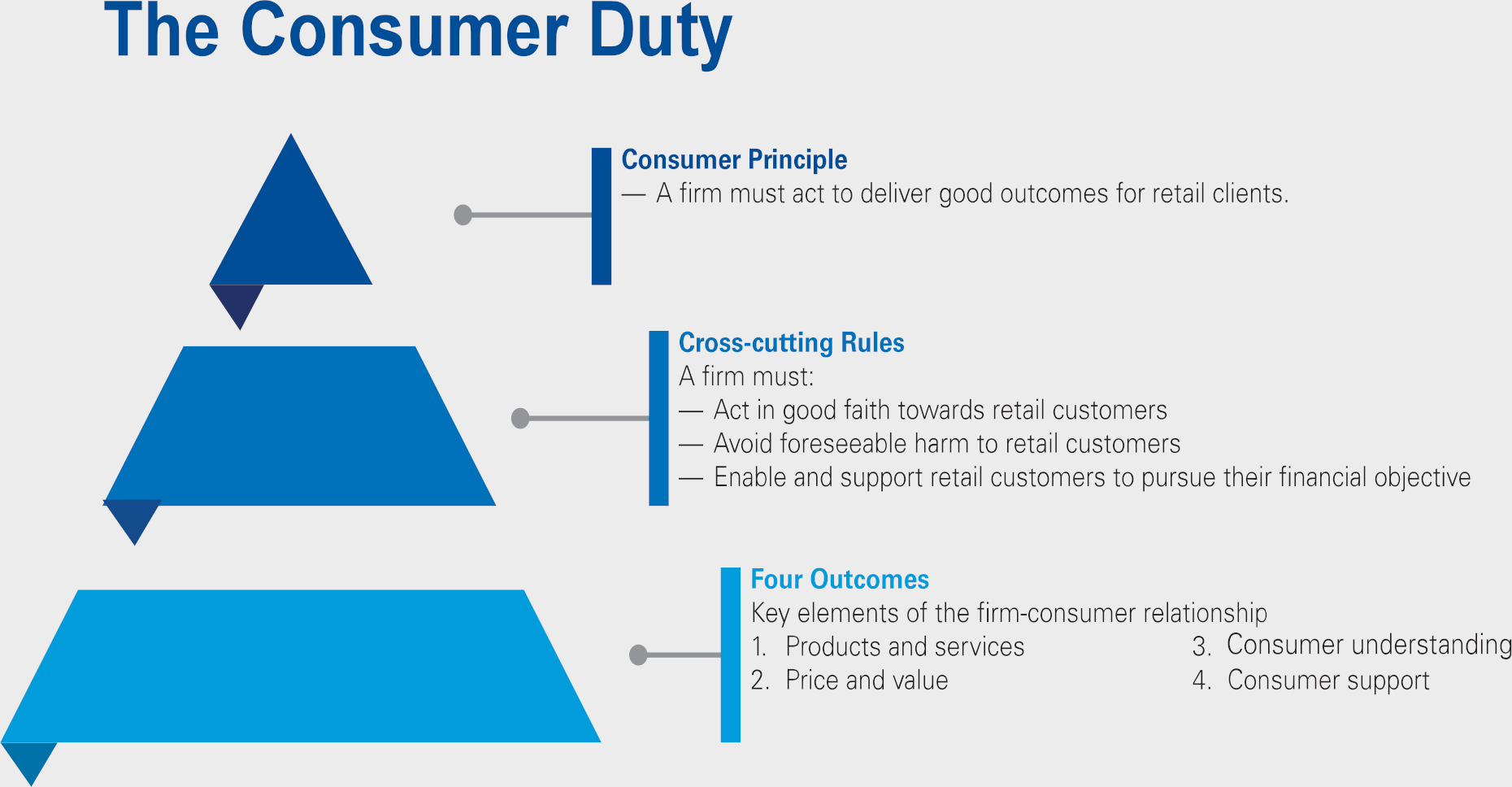

The Consumer Duty is a package of measures comprised of:

-

A new Consumer Principle (Principle 12) that provides a high-level expectation of conduct and associated outcomes.

-

A set of overarching cross-cutting rules which develop and amplify the standards of conduct that the FCA expects under the Consumer Principle.

-

The four outcomes, which are a suite of rules and guidance setting more detailed expectations for a firm's conduct according to the four specific outcomes that represent the key elements of the firm and its consumer relationships.

Cross-cutting rules

The cross-cutting rules strengthen the standards of conduct the FCA expect under the Consumer Principle. They develop the FCA's overarching objectives for firm behaviour through three common themes applying across all areas of a firm's conduct. They also intended to inform and help firms interpret the four outcomes.

-

Act in good faith toward retail customers.

-

Avoid foreseeable harm to retail customers.

-

Enable and support retail customers to pursue their financial objectives.

The four outcomes

The four outcomes represent the key elements of the firm-customer relationship. The behaviour and actions of firms in relation to each of these outcomes are instrumental in enabling consumers to meet their financial needs and improve their financial wellbeing.

-

Products and services.

-

Price and value.

-

Consumer understanding

-

Consumer support

The outcomes establish the suite of rules and guidance setting the FCA's expectations of firms under the Consumer Duty, and whilst standalone, are unsurprisingly interlinked. For example, poor product design or governance may impact fair value considerations. Across all outcomes there is an expectation that:

-

Firms review their current approaches to bring them in line with the Consumer Duty requirements.

-

Firms ensure they can evidence outcomes.

-

Outcomes are reviewed and monitored on an ongoing basis.

-

Any issues identified are remedied or mitigated.

Governance and accountability

The FCA expects the focus on acting to deliver good outcomes will be at the heart of firms' strategy and business objectives. It expects firms to embed the duty in the same way, and receive the same level of ongoing attention, as they have with financial performance or risk.

Under the Consumer Duty, a firm's board or board equivalent, will be responsible for assessing whether it is delivering good outcomes for its customers which are consistent with the Consumer Duty. As such, firms will need to determine what type, frequency and level of granularity their board will need engage to be able to provide this assurance.

SM&CR will apply to the Consumer Duty as it does to other Principles and rules. The FCA doesn't want the responsibility for compliance with all elements of the Consumer Duty to apply to one individual. Instead, the responsibility should permeate throughout senior management and the design, distribution and delivery life-cycle. All senior managers are responsible for ensuring that the

Business of the firm complies with the requirements of the Consumer Duty on an ongoing basis. Therefore, the way firms design, implement, assess and monitor its solution to evidence outcomes will need to be a core focus of implementation activity at all levels of management.

FCA expectations of firms under the Duty

Firms should:

-

put consumers at the heart of their business and focus on delivering good outcomes for customers.

-

provide products and services that are designed to meet customers’ needs, that they know provide fair value, that help customers achieve their financial objectives and which do not cause them harm.

-

communicate and engage with customers so that they can make effective, timely and properly informed decisions about financial products and services and can take responsibility for their actions and decisions.

-

not seek to exploit customers’ behavioural biases, lack of knowledge or characteristics of vulnerability.

-

support their customers in realising the benefits of the products and services they buy and acting in their interests without unreasonable barriers.

-

consistently consider the needs of their customers, and how they behave, at every stage of the product/service life-cycle.

-

continuously learn from their growing focus and awareness of real customer outcomes.

-

ensure that the interests of their customers are central to their culture and purpose and embedded throughout the organisation.

-

monitor and regularly review the outcomes that their customers are experiencing in practice and take action to address any risks to good customer outcomes.

-

ensure that their board or equivalent governing body takes full responsibility for ensuring that the Duty is properly embedded within the firm, and senior managers are accountable for the outcomes their customers are experiencing, in line with their accountability under the Senior Managers and Certification Regime(SM&CR).

How this applies to unregulated activities

The Duty only applies within the FCA’s regulatory perimeter, so will not apply to unregulated business. It does not, for example, apply to credit products outside our remit, such as unregulated business lending. However, at Capital Fleet all customers should be treated within the spirit of the Consumer Duty guidelines.

The Consumer Principle

The Consumer Principle, Principle 12, requires firms to ‘act to deliver good outcomes for retail customers’.

It sets a higher standard than both:

-

Principle 6 – A firm must pay due regard to the interests of its customers and treat them fairly.

-

Principle 7 – A firm must pay due regard to the information needs of its clients and communicate information to them in a way which is clear, fair and not misleading.

Principle 12 reflects the positive and proactive expectations we have of firm conduct, and our desire for firms to think more about customer outcomes and place customers’ interests at the heart of their activities.

It should prompt firms to ask themselves questions such as, ’Am I treating my customers as I would expect to be treated in their circumstances?’ or, ’Are my customers getting the outcomes from my products and services that they would expect?’.

Principle 12 imposes obligations on firms towards customers of products and services, irrespective of whether the customer is a direct client of the firm.

Firms should consistently challenge themselves to ensure their actions are compatible with customers’ interests and financial objectives.

Principle 12 focuses on customer outcomes, and requires firms to:

-

pro-actively act to deliver good outcomes for customers generally and put customers’ interests at the heart of their activities

-

focus on the outcomes customers get, and act in a way that reflects how consumers actually behave and transact in the real world, better enabling them to access and assess relevant information, and to act to pursue their financial objectives

-

ensure they have sufficient understanding of customer behaviour and how products and services function to be able to demonstrate that the outcomes that would reasonably be expected are being achieved by those customers

-

where they identify that good outcomes are not being achieved, act to address this by putting in place processes to tackle the factors that are leading to poor outcomes, and consistently and regularly challenge themselves to ensure their actions are compatible with delivering good outcomes for customers

Consumer and firm responsibility

The Duty does not remove consumers’ responsibility for their choices and decisions. However, consumers can only be expected to take responsibility for their actions when they are able to trust that the range of products and services they choose from are designed to meet their needs, and offer fair value. They need help to understand products and services, and they need confidence that firms will act in a way that helps, rather than hinders, their ability to make decisions in line with their needs and financial objectives.

Under the Duty, firms are responsible for enabling and empowering consumers to take responsibility for their actions and decisions.

Some consumers’ low levels of financial capability, financial resilience or confidence in managing their money and finances, coupled with behavioural biases, means regulators cannot set a universal requirement of the degree of responsibility a consumer can be expected to take. Firms must understand and take account of behavioural biases and the impact characteristics of vulnerability can have on consumer needs and decisions.

The cross-cutting rules

The Duty includes three cross-cutting rules which set out how firms should act to deliver good outcomes for retail customers. They require firms to:

-

act in good faith towards retail customers

-

avoid causing foreseeable harm to retail customers

-

enable and support retail customers to pursue their financial objectives

The cross-cutting rules articulate the standards of conduct that we expect under Principle 12. They set out how firms should act (proactively and reactively) to deliver good outcomes for customers. As with the rest of the Duty, they apply both at a target market level and an individual customer level, depending on the situation.

The cross-cutting rules work together as a package, and poor conduct will often breach more than one of the cross-cutting rules.

-

For example, acting in good faith is a key part of creating an environment in which customers can make decisions in their own interest and pursue their financial objectives. It is also a key part of acting to avoid causing foreseeable harm. If a firm continues to sell a product it knows to be causing harm, it is also likely to be acting in bad faith.

-

Similarly, a firm that does not act to avoid causing foreseeable harm is also not likely to be acting to enable and support customers to pursue their financial objectives. For example, where a firm fails to explain the risks of a product to customers, it is unlikely to be acting to avoid causing foreseeable harm or enabling and supporting customers to pursue their financial objectives.

Guidance for distributors (Capital Fleet & it’s employees)

Firms are distributors if they offer, sell, recommend, advise on, arrange, deal, propose, or provide a product or service, including at renewal. Some of these terms – selling, arranging and dealing – use Handbook definitions to clarify their meaning. Elsewhere, the terms take their plain language meaning. The concepts are deliberately broad, and the terms may overlap, to capture all aspects of the distribution of a product or service.

The distribution arrangements must:

-

avoid causing and, where that is not practical, mitigate foreseeable harm to customers

-

In relation to management of conflicts of interest, for example, firms should not make any arrangements, such as by way of remuneration or sales targets, that could provide an incentive to employees to recommend a particular product or service when an alternative would better meet a customer’s needs.

Distributors (us) must get appropriate information from manufacturers (finance companies)so they have the necessary understanding of the products or services they distribute. The information must allow them to:

-

understand the characteristics of the product or service

-

understand the identified target market

-

ensure the product or service will be distributed in accordance with the needs, characteristics and objectives of the target market

Firms should not distribute a product or service if they do not understand it sufficiently.

Firms distributing products or services manufactured by firms to which the products and services outcome does not apply should take extra care when reviewing their distribution arrangements. They should consider whether the product or service remains appropriate for the needs, characteristics and objectives of the target market.

In order to monitor this outcome, firms could consider data such as:

-

sales information and information on business persistency

-

customer feedback

-

complaints received about the product or service, and the results of root-cause analysis of those complaints

-

analysis of whether the product or service functions as expected at outset, including whether customers use product or service features as expected

If firms identify issues in their review, they must take appropriate action to mitigate the situation and prevent further harm from occurring. Where appropriate, they must inform other firms in the distribution chain about their actions.

In terms of action they could take, firms could consider, for example, making changes to a product or service, providing additional information to distributors or customers, amending the distribution strategy before making further sales, offering existing customers the option to leave the product or service without additional cost, or providing appropriate mitigation of any harm suffered.

The price and value outcome

Retail customers experience harm where they don’t get value for their money. A lack of fair value is unlikely to be consistent with customers realising their financial objectives and firms cannot act in good faith if they are knowingly manufacturing or distributing poor value products or services.

Fair value is about more than just price. The Duty aims to tackle factors that can result in products or services which are unfair or poor value, such as unsuitable features that can lead to foreseeable harm or frustrate the customer’s use of the product or service, or poor communications and consumer support.

The specific focus of the price and value outcome rules is on ensuring the price the customer pays for a product or service is reasonable compared to the overall benefits (the nature, quality and benefits the customer will experience considering all these factors). Value needs to be considered in the round and low prices do not always mean fair value. We expect firms to think about price when assessing fair value but not at the expense of other factors.

In order to assess if a product or service provides value, firms must consider at least the following:

-

the nature of the product or service, including the benefits that will be provided or may reasonably be expected and their qualities

-

any limitations that are part of the product or service (eg limitations on scope of cover for insurance products), and

-

the expected total price customers will pay, including all applicable fees and charges over the lifetime of the relationship between customers and firms

The consumer understanding outcome

Consumers can only be expected to take responsibility where firms’ communications enable them to understand their products and services, their features and risks, and the implications of any decisions they must make about financial products and services.

We want customers to be given the information they need, at the right time, and presented in a way they can understand. This is an integral part of firms creating an environment in which customers can pursue their financial objectives.

Our consumer understanding outcome rules retain the obligation under Principle 7 for firms to communicate information in a way which is clear, fair and not misleading. But they also build on, and go further than, Principle 7 by requiring firms to:

-

support their customers’ understanding by ensuring that their communications meet the information needs of customers, are likely to be understood by customers intended to receive the communication, and equip them to make decisions that are effective, timely and properly informed

-

tailor communications taking into account the characteristics of the customers intended to receive the communication – including any characteristics of vulnerability, the complexity of products, the communication channel used, and the role of the firm

-

when interacting directly with a customer on a one-to-one basis, where appropriate, tailor communications to meet the information needs of the customer, and ask them if they understand the information and have any further questions

-

test, monitor and adapt communications to support understanding and goodnoutcomes for customers

These rules apply:

-

to all firms involved in the production, approval or distribution of consumer communications, regardless of whether the firm has a direct relationship with a customer, and includes where a firm produces or approves financial promotions or other advertisements, sales-related communications and post- sale communications

-

at every stage of the product or service life-cycle, from marketing, to sale, and post-sale service

-

to all communications, whether verbal, visual or in writing, from a firm to a customer, including a potential customer, regardless of the channel used or intended to be used for the communication

Providing support that meets the needs of customers

The support that firms provide should enable customers to fully utilise the products and services they purchase and act in their interests. Firms should ensure their customers are adequately supported throughout the life-cycle of a product or service after the point of sale – in particular, if they want to make an enquiry, claim, complaint or switch provider.

This means that firms should ensure their support processes avoid causing foreseeable harm and enable and support customers in pursuing their financialobjectives. Consumer harm can arise due to failings in the support firms provide, such as:

-

under-resourced customer helplines, for example where firms disproportionately focus on pre-sales, over after-sales, support

-

phone systems, menus or webchats that are difficult to navigate

-

badly designed websites that make it difficult for customers to find key information online

-

uncertainty around how or where to access support, or poor hand-off processes, including where third parties are involved in its provision

Data and monitoring - The types of data/ monitoring firms could use

Firms could use the following types of data to monitor that they are meeting expectations under this outcome:

-

analysis of customers’ use of products and services

-

root-cause analysis of complaints

-

customer persistency or retention information

-

first contact resolution rates and average time to resolution

-

speed to answer the telephone and average wait times, call abandon rates

-

email and digital channel speed to answer

-

internal quality assurance

-

customer call listening exercises

-

satisfaction surveys

-

net promoter scores

Key questions for firms:

-

How has the firm satisfied itself that its customer support is effective at meeting customer needs regardless of the channel used? Does the firm test outcomes across different channels?

-

What assessment has the firm made about whether its customer support is meeting the needs of customers with characteristics of vulnerability? What data, MI and customer feedback is being used to support this assessment?

-

How has the firm satisfied itself that it is at least as easy to switch or leave its products and services as it is to buy them in the first place?

-

How has the firm satisfied itself that the quality of any post-sale support is as good as the pre-sale support?

-

What data, MI and feedback is the firm using to monitor the impact its consumer support is having on customer outcomes? How often is this data monitored, and what action is being taken as a result?

-

How effective is the firm’s monitoring and oversight of outsourced or third- party service providers, and is it confident that these services meet the consumer support standards?